What is Bond?

The electronic trading market is experiencing rapid development and transformation due to the emergence of the crypto market, which has allowed using all the advantages of distribution registries to multiply capital. However, despite this, the classic trading instruments included in stock trading are still in high demand, especially regarding the balance between profitability and risk. One such instrument is the bond.

This article will shed light on what bonds are and how they work. You will also learn how bonds differ from stocks and the process of buying and selling them.

Key Takeaways

- Bonds are securities that entitle their holder to receive a predetermined income at a specified time.

- The main difference between bonds and shares is that they give a stable income in the form of interest (coupons), while the latter give an unstable income from the sale with dividends.

- Bonds can be bought on the stock market as part of a primary or secondary placement.

What is Bond in Simple Words?

A bond is an issuance security certifying its holder’s right to receive its face value or another property equivalent from the issuer of the bond within the period of time stipulated therein. The bond may also certify the right of its holder to receive the interest on the nominal value of the bond or other property rights stipulated therein. The bond yield is interest and (or) discount.

A bond is a loan certificate that has a final maturity date. Bond income is paid (interest income) or redeemed (discount income) preferentially before share income in the form of dividends. Bond income also takes precedence over other obligations (e.g., when a joint stock company is liquidated, the money after loans are repaid first to bondholders and only then to stockholders). But bonds do not give the right to participate in the management of the joint stock company.

A wide range of classification features determines each type of bond. Among them is the form of ownership of the issuer, maturity, type of ownership, forms of circulation, security with assets, method of obtaining income, and regulation of maturity. At the same time, it is believed that the main characteristic of bonds is based on the yield, which can be a discount or interest.

Discount bonds are placed by the issuer at a price below their face value and are redeemed at face value. In this case, the investor’s income on the bond will be the discount – the difference between the purchase price of the bond and the face value of the bond paid by the issuer at maturity of the bond.

Interest-bearing bonds are placed by the issuer, as a rule, at face value and are redeemed at face value. The income on such a bond will be interest, which can be both constant and variable, paid both periodically (monthly, quarterly, annually, etc.) and when the bond is redeemed. The amount of income or the procedure for determining it, including the amount of income for each interest period, in the case of establishing a periodically paid income, is determined by the issuer and reflected in the decision to issue bonds and the emission prospectus.

Bonds have the broadest classification among trading instruments, which includes more than ten different characteristics.

How Do Bonds Work?

Today, bonds remain a popular tool for investment activities mainly because of the high rate of interest income, unchanged during the circulation of the bond issue. On the other hand, bonds are a structural financial instrument, one important indicator of which is the current market rate, the value of which directly affects the degree of investors’ interest in buying them.

Explore Deeper Industry Insights

Learn from experts shaping the future of financial services — get the latest strategies and trends.

Determination of the current market rate of a security can be based on the application of dynamic methods, in particular, the NPV – net present value (income capitalization) method, according to which the value of any financial asset is presented as the present (current) value of future payments coming from its use. The use of the expected income capitalization method as a pricing model in the securities market can be justified for financial instruments with guaranteed nominal yields, i.e., for bonds. The formula below is called the basic bond pricing model:

Pb= [K/(1+r)t]+H(1+r)T,

where H – the face value of the bond,

K – coupon payments,

r – annual interest rate,

t – term to maturity,

T – circulation period of the bond.

The economic meaning of this formula is that the bond’s present value is equal to the sum of all interest payments during its circulation period and the par value, brought to the present time, i.e., discounted at the rate of current yield for this type of bond. It is assumed that the current rate of return is the minimum required return expected by investors on alternative risk-free investments and the risk premium. Hence, the present value of a bond – prescribes to it the value at which the investor would wish to purchase it. The discount factor is the market rate of return, i.e., the average of the expected returns by some investors (this determines the supply and demand ratio for a given bond), then the current value of the bond can be viewed as the market price.

A bond can generate income due to the change in the value of the bond from the time it is purchased to when it is sold. The difference between the bond’s purchase price and the price at which the investor sells the bond represents an increase in capital invested by the investor in a particular bond. This type of income is generated primarily by bonds purchased at a price below par, i.e., at a discount. When selling bonds at a discount, an essential point for the issuer is to determine the bond’s selling price. In other words, at what price the bond should be sold today if the amount to be received in the future (par value) and the underlying rate of return (refinancing rate) are known. The calculation of this price is called discounting, and the price itself is the present value of the future amount of money.

Difference Between Bonds and Stocks

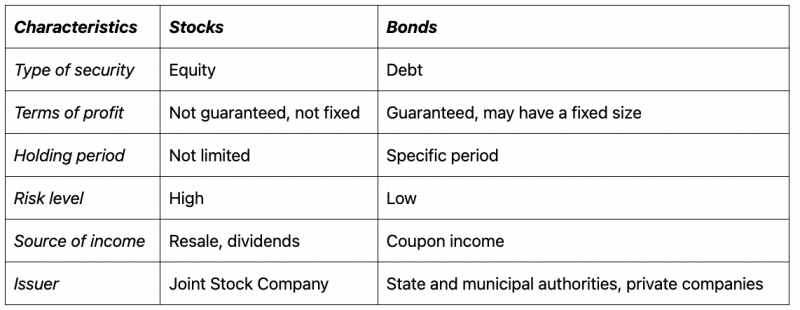

Stocks and bonds form the backbone of the stock market, representing some of the most popular investment instruments among both private and institutional investors. Stocks are issued by a joint stock company at its incorporation and is a certificate of the contribution of a particular share in the company’s share capital. A bond is a debt obligation under which the issuer must repay the specified amount of the bond to its holder within a specified period. These types of trading assets have many significant differences, determining their unique properties in the framework of investment activities.

Type of Security

Stocks are a financial instrument that allows the investor to own a share in the company, which gives him the right to receive a certain percentage of profits in the form of dividends, the amount of which is usually set by the company’s board of directors. As a consequence, stocks are a type of equity securities. On the other hand, bonds are a financial debt asset that involves the issuer paying an amount that has become a pledge to the investor to receive interest on the use of his money. This aspect is the most essential difference between the above-mentioned financial assets.

Terms of Profit

Investing in stocks, regardless of their type, the investor has no guarantees of profitability and cannot count on profit because the nature of this trading instrument has a cyclical nature whose financial value, as well as its market value, is based on several factors that form the conditions for its purchase or sale. In this case, only owning stocks gives the investor the right to expect profit in the form of dividends if provided. In the case of bonds, the income from their purchase is known in advance in the form of coupon payment and is calculated based on individual conditions, including the amount invested, the term of investment, etc. However, there is an exception here, under which the investor will not receive income from the purchase of bonds in the event of bankruptcy/liquidation of the issuer’s company.

Holding Period

Stocks can be seen as a free financial instrument without maturity (sale). Once purchased, they can be stored indefinitely on the depo account of the broker, whose services are used by the investor and can be sold at any time at his will and following his trading strategy. Ownership of bonds implies a specific period within which they must be redeemed. There are short-term bonds (redemption up to 1 year), medium-term bonds (redemption up to 5 years), and long-term bonds (redemption in 5 years and later).

It should be noted that bonds do not have to be held in a portfolio until maturity. If you sell a bond between coupon payments, the seller will receive from the next owner the accumulated coupon income – part of the coupon – in proportion to each day of ownership.

Risk Level

The nature of any financial market implies a balance between investment returns and risks. This provision is the basis of the law, which states that the risk increases proportionately to the return and vice versa. In this sense, stocks should be considered as a financial instrument with an average ratio of risk to profit and, by and large, due to the availability of the option to use margin trading, the essence of which is to use borrowed funds of an exchange (or a broker) to multiply profit. Bonds, in turn, are a low-risk trading instrument that does not involve the use of leverage for trading and, consequently, does not carry position liquidation risks in case of an incorrect trading strategy.

Source of Income

Regarding returns, stocks can be a priority for many investors because they provide more flexible opportunities for capital appreciation. As mentioned above, owning a stock allows an investor to make a profit which, on the one hand, is expressed as the difference between the purchase or sale price (or the sale price and the purchase price if we talk about short trading) and, on the other hand, the amount of dividends, the timing, and amount of which is determined individually by each joint-stock company. Bonds provide income only in the form of coupons, which are interest accrued on the face value of the bonds within a certain period.

Issuer

If the issue of shares is carried out only within the framework of the relevant joint stock company, the bonds may also be issued by entities with other organizational and legal form, including state and municipal bodies, private companies, etc. At the same time, the terms of the bond issue will differ depending on the form of management and a number of other factors.

How to Buy and Sell Bonds?

Speaking about the implementation of financial transactions with bonds (purchase and sale), it should be noted that it is somewhat similar to the stock market, especially in terms of purchase. This process can be carried out in different conditions, namely, during the primary or secondary placement of bonds. Let’s consider each of them in more detail.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

Primary Placement

A primary offering is a process whereby the issuer itself sells the bonds immediately after they are issued. The broker or issuer collects bids from investors and then distributes the entire issue of securities to them. The bond price is equal to the face value, and the yield is the coupon yield.

Investors, by purchasing bonds at the initial offering, finance the issuers. In legal terms, a loan agreement is entered into by placing bonds. The document securing the rights under the bonds (decision on the issue, etc.) specifies the right of its holder to receive, within the time stipulated by it, from the issuer, the face value or other property equivalent.

The process of purchasing bonds at the initial offering is quite simple and, to begin with, involves submitting a purchase order via a terminal or application specifying the purchase volume. Here it should be taken into account that the bonds must be placed by public subscription, and before the purchase, you need to know for how long the order book will be open (usually from a few hours to a few days, in rare cases – up to a month).

If the broker used by the investor himself participates in the bond offering, there probably won’t be any problems with filing an application. If not, the investor must submit an instruction to the broker to make an offer to the offering organizer on his behalf. However, not all brokers provide such an opportunity. The refusal to put up an offer for another market participant (most likely a competitor) is a fairly typical story.

Secondary Placement

Secondary placement is the process of selling previously issued bonds on the exchange. In a secondary offering, bonds are not purchased from the issuer, but from other investors. Therefore, the price of the bond may differ from the face value, as well as the yield. This method of buying bonds can have its own subtleties in terms of acquisition due to the fact that it is based on the purchase of securities from other investors.

As for the selling process, in both methods of buying it will be the same and will include the stage of placing an order to sell at the broker with a predetermined amount of sale. This operation is also carried out within the trading terminal or application.

Conclusion

Bonds, despite the emergence of new financial markets, along with stocks remain a classic, time-tested class of trading assets, work with which guarantees a stable yield and low risks, which is the ideal ratio of trading potential for many categories of investors, especially for beginners who are just beginning their way into the field of investment in stock market instruments.

Recommended articles

By clicking “Subscribe”, you agree to the Privacy Policy. The information you provide will not be disclosed or shared with others.

Our team will present the solution, demonstrate demo-cases, and provide a commercial offer